Archive for the ‘posts in english’ Category

Hearing on Speculative Position Limits in Energy Futures Markets, July 28, 2009

British Petroleum reported second quarter results with earnings off 53 percent compared to the same period last year. The company still earned $4.39 billion compared to $9.3 billion a year ago, but during the quarter the price of oil had averaged $59.13 a barrel compared to a stunning $121.18 in the second quarter of 2008.

Several industry insiders and analysts have stated time and again that based on fundamentals of supply and demand the price of oil should not exceed $60 per barrel and yet in the last 12 months we have seen prices spike to $150, to fall back to about $30 and to rise again to about $70 in the first half of 2009. Even the staunchest free market defendants will have a hard time to explain these prices swings.

While the oil industry is still coping well with the current situation others are more unfortunate. In a recent CFTC testimony Ben Hirst on behalf of the Air Transport Association of America outlined that airlines consumed 5 percent fewer fuel in 2008 yet their fuel costs went up by $16 billion. According to Hirst who is also senior vice president of Delta Airlines fuel expenses consumed 40 percent of Delta’s total revenue in 2008, forcing the company to lay off about 10000 employees. A price swing of $1 had an annual impact of $100 million to Delta’s bottom line.

This reminiscent of beg-thy-neighbor policy where some are profiting handsomely at the expense of others has now become the subject of a series of hearings by the Commodity Futures Trading Commission (CFTC). The hearings are scheduled to be held between 9:00 a.m. EDT and 1:00 p.m. EDT on Tuesday, July 28, Wednesday, July 29, and Wednesday, August 5, 2009. In the spirit of transparency all hearings will be live webcast and testimony and statements as well as supplementary material will be available till August 12, 2009.

The subject of the hearings concerns the recent price volatility in energy futures trading and their impact on the spot price for this diverse class of commodities. Chairman of the CFTC Gary Gensler laid out the primary objective to gather information from a wide-range of industry participants and academics in several points. The most important are 1) how to apply aggregate position limits consistently across all markets and participants and 2) how to deal with exemptions from position limits by bona fide hedgers and others.

As chair Gensler pointed out in his statement 37 exemptions were granted to NYMEX spot month speculative position limits for crude oil as of July 21, 2009. The average size was 5.639 contracts, almost 2 times the size of the 3000 contracts set as position limit. A survey conducted by the CFTC from July 1, 2008 to June 30, 2009, found that in the nearby NYMEX futures contract for WTI crude oil 2 traders exceeded 10% or more of open interest in all futures and options combined. The largest trader’s position held 14% of OI total. In the first deferred month 5 traders exceeded 10% of OI with a maximum of 18% OI, and in the second deferred month 6 traders held more than 10% with a maximum of 19% OI. This of course does not include bilateral swap trades because CFTC does not have regulatory oversight within the dark pool of OTC markets.

For senator Bernard Sanders Rome is burning, using his words to characterize the current situation in the energy markets. As the first one to testify in this most recent hearing he demanded that the CFTC takes urgent action and puts an end to heads, bankers win; tails, everyone else loses.

Last year Sanders introduced S.1225, the Energy Markets Manipulation Prevention Act, to address rampant speculation. Last July the House of Representatives overwhelmingly passed similar legislation by a strong bipartisan vote, yet S.1225 did not become law. Congressman Bart Stupak also introduced legislation included in the American Clean Energy and Security Act (ACESA), which recently passed the U.S. House of Representatives and is now pending in the Senate.

In his testimony Stupak emphasized the influence index investors have on price developments. From January 2008 till the end of June 2008 index investors were responsible for $55 billion of hot money inflows driving the price of oil from $99 to $140 per barrel. A massive financial crisis caused investors to withdraw $73 billion over the next six months, and the price collapsed to about $30 per barrel. Since the end of 2008 index investors have again increased their holdings of future positions by 30 percent to the equivalent of more than 600 million barrels of crude oil.

During his testimony he also addressed the issue of non-commercial traders, namely those banks, hedge funds and large institutional investors who qualify as speculative traders and yet are able to operate under almost unlimited conditions. As of June 30, 2008, at the height of the commodities bubble, non-commercial traders held about 60 percent of the open interest in natural gas markets, and 75 percent of the West Texas Intermediate crude oil market. At the same time commercial traders, who actually take delivery of physical oil because they need it to operate their businesses, held only about one third of the long positions in OTC markets.

The CFTC is an independent agency of the United States government and operates under the regulatory powers of the Commodity Exchange Act (CEA) enacted June 15, 1936. In 1974, congress amended the Act in an attempt to provide more comprehensive regulatory oversight for the trading of future contracts, and created the Commodity Futures Trading Commission. Since then the commission has fine tuned its regulatory framework but many including Sanders and Stupak urge CFTC to take more decisive steps towards regulation of future markets.

For any additional regulation to be successful it will be necessary to close loopholes many energy traders are using today to circumvent existing regulation. Most importantly 1) swap exemptions included in the CEA, 2) Foreign Board of Trade no Action letters, and 3) general swap loopholes which allow swap dealers to circumvent position limits. Hopefully the hearings will help to deal with these very issues, since they are crucial to any successful attempt to reign in rampant specs in energy markets.

The Intercontinental Exchange (ICE) is under the supervision of authorities in the UK although it is based in Atlanta, U.S.A. ICE is the largest internet market place to trade futures and OTC energy and commodity contracts in the world and as such detrimental to price developments in energy markets. The exchange cooperates with the CFTC though a no-action letter prevents the commission to impose tough regulation on foreign markets. This loophole has to be closed.

Similar to ICE the Dubai Mercantile Exchange (DME) is a fully electronic exchange with its contracts listed on CME Globex and primarily offers energy futures contracts. The DME is regulated by the Dubai Financial Services Authority and can serve as another loophole for trigger happy energy traders. In August 2008 the CME has acquired a 32.5% stake in the DME from NYMEX. In addition about 20% belong to Goldman Sachs, Morgan Stanley, Shell and JP Morgan.

In 1991, CFTC authorized the first bona fide hedging exemption to a swap dealer, since then 15 different investment banks have taken advantage of this exemption. Since 2006, NYMEX has granted 117 hedging exemptions for West Texas Intermediate crude contracts, many of which are for swap dealers without physical hedging positions. These exemptions have to end and swap dealers need to come under the umbrella of conventional regulation by the CFTC.

Craig Donohue, Chief Executive Officer of CME, admitted that future exchanges took disciplinary actions in 1,334 cases, levying fines and restitutions of $10.3 million, suspending traders for a total of 3,414 days and barring 22 traders from trading at the exchange for at least a year in some cases. According to his testimony he is ready to adopt a hard limit regime to regulate energy future contracts that will include all-months combined limits and tailored hedge exemptions for swap dealers and index funds.

But that’s about as far as Donohue goes. During his testimony he defied any involvement of speculation in the recent volatility in energy prices. As much as he condoned this unfortunate development supply and demand remained as the sole culprit. To support his thesis he cited research that used quantitative evaluations rather than qualitative ones from his opponents. In January this year a GAO report did not grant conclusive evidence to some of those qualitative studies which designate speculators as being responsible for the price swings in energy markets. A Wall Street Journal survey of 53 economists agreed and found that market fundamentals were driving prices of food and energy.

Donohue confronted the issue of causation by citing evidence that net long exposure of futures-equivalent swap positions declined by 11% in the first half of 2009, refuting the fact that speculators were behind the run up in energy prices during this time period. This somehow neglects the issue of absolute positions in a sense that even less of something can still be a lot, and I do not think it can be used as an effective argument against a casual relationship between speculators and excessive price movements in energy futures and spot prices.

According to Donohue an exchange and not the CFTC is best suited to police activities in its markets. This is very reminiscent of what Siebel Harris, then vice-president of Chicago Board of Trade, said to senator Capper in a 1936 hearing about the establishment of the CFTC. Capper responded: “I take it that your position all hangs on this point, that you want the board of trade to make all the rules and regulations governing the grain trade rather than an impartial agency of the Government that will function in the interest of all parties interested?”

The most compelling argument of those who support speculation has historically been to provide liquidity to the market and in doing so helping to find the real price for the underlying commodity. For them the logic followed the more speculation in the markets the better for transparency and price discovery. Granted the mediators in this process were the regulators but markets worked best with the least amount of regulation possible.

Senator Saunders begged to differ and saw Rome burning with respect to modern day players in the field of energy speculation. He therefore suggested three swift and unmitigated actions. 1) Immediately classify all bank holding companies and hedge funds engaged in energy futures trading as noncommercial participants and impose strict positions limits on them. 2) Eliminate the conflicts of interest between Wall street’s trading desks and their internal research departments. 3) Revoke all staff no-action letters for foreign boards of trade that have established trading terminals in the United States.

Were CFTC to follow these three simple rules excessive volatility in energy prices would almost certainly be a relict of the past. The question is not will it be effective but rather will regulators have what it takes to pierce the zone of influence of powerful financial institutions. Since the necessity to act is so urgent, by no means is it trivial anymore to be complacent and ignore the call for action, there is a good chance we might get tougher regulation this time, even though traders will explore all possible venues to avoid it.

Is CRE the next accident to happen?

Commercial real estate is shaping up to become another causality of the financial crisis and CRE mortgage delinquencies and loan defaults are now starting to pile up on the balance sheets of US financial institutions. That is of course on top of losses from residential real estate, consumer credit and the securitization markets that sort of connect all the sore spots on Wall Street.

$817 billion of total CRE-loans are still outstanding in June, 2009, and about 29 billion have run into trouble. In the month of June loan delinquencies soared by $10 billion heating up the debate about future CRE losses by financial institutions.

But that’s not all. About $105 billion worth of troubled loans have been worked out. A majority of those loans experienced an averaged loss of almost 64 percent. Delinquency rates on CRE are up to 4.5 percent in the second quarter from 3.6 percent in the first quarter, 2009.

Similar to residential real estate CRE property prices have also collapsed. Moodys/REAL Commercial Property Price Index (CPPI) has not bottomed as of April 2009:

In CRE much like with residential real estate many loans have been securitized and actual losses to financial institutions and investors will therefore depend largely on two conditions. First, the total amount of loan defaults will be substantial given the collapse in prices. Second, FASB statements 166 and 167 will determine how big the losses are or if they can be deferred onto some future time horizon.

FASB statements 166 and 167 refer to securitized loans in special purpose entities, and require banks to consolidate insufficiently capitalized SPEs onto their balance sheets. Although this should foster more disclosure for investors its impaired with whims of possible rule-bending.

FASB determination to implement these rules is another uncertainty factor. In April, 2009 FASB halted fair value accounting to stop the hemorrhaging of impaired financial assets. Statements 166 and 167 are supposed to take effect in the first fiscal quarter beginning after November 15, 2009.

Some are already preparing for the worst. Bank of America now expects to bring about $150 billion back onto its balance sheet under the new FASB rules. This 150 billion off-balance-sheet assets comprise of $12 billion home equity conduits, $85 billion card securitizations, and other variable interest entities make up the remaining $53 billion. Maybe BofA is just lucky.

Wall Street – Washington Connection, Part I

When we think about the financial crisis on Wall Street and in the economy we try to figure out why it happened, who was responsible and how can we prevent it from happening again in the future. Today we still have a lot more questions than we have answers, but the sun is beginning to shine, and one issue is starting to emerge which probably for years and years has been tucked away from the public’s view.

This crisis is pulling the blanket of secrecy from a bunch of Wall Street bankers smooching and spooning undercover with Washington’s big guys for the last several decades. Of course we would expect them to be somewhat embarrassed about busting their secret arrangements, maybe even flee the scene to break up their unholy unity for good. Much to our surprise none of this is actually happening.

Mr. Dimon, chairman and head of JPMorgan Chase, has sought to ratchet up his business of influencing Washington in late 2007, when the financial crisis hit and the democrats together with the Obama administration were beginning to settle in. Jamie Dimon together with Goldman’s Loyed Blankfein are among a rare breed of executives who have not jeopardized their companies by taking unwise decisions. Both CEOs in the meantime have returned all funds received from Treasury’s capital assistance programs (CAP).

These days JPMorgan’s chairman comes to town about twice a month and not twice a year as he used to. He met with Treasury secretary Geithner, White House economic advisor Lawrence Summers, and several lawmakers in recent months and gets a list from his staff to call a half-dozen public officials each week. He has made it a regular thing to nurse his precious Washington relations to make sure he is not kept out of the loop.

When JPMorgan wanted to return its TARP funds his influential connections helped him to ease the terms for banks allowing them to repay the money. In the end Washington caved in to Dimon’s complaints about limitations for hiring skilled foreigners and on executive pay. He also helped thwart attempts to lower the principal on mortgage payments which would have benefited homeowners.

Another contentious issue is Mr. Dimon’s objection to regulate the market for credit derivatives by keeping part of it independent from regulated clearing operations. Fees from underwriting over-the-counter credit derivatives are a major source of income for JPMorgan Chase.

Mr. Dimon’s connections to Washington date back to his day at Citigroup when he offered Mr. Rahm Emanuel, then senior advisor to president Bill Clinton, a job at the firm. Today Mr. Emanuel serves in the Obama administration as White House Chief of Staff. William Daley, former commerce secretary and influential Chicago lobbyist, is also currently on JPMorgan’s payroll. Mr. Dimon mindfully replaced some of his staff with wired democrats to better serve his Washington agenda.

Most surprising is his connection to Treasury secretary Geithner. Mr. Dimon holds a seat on the board of the New York Federal Reserve. Mr. Geithner served as president of the NY Fed till he joined the Obama administration in January of this year. How can a CEO of a public company sit on the board of a federal regulator? That’s like John Gotti being a member of the U.S. Department of Justice.

For the first time this Monday JPMorgan Chase held a meeting of the firm’s board in the nation’s capital. Messrs. Geithner and Emanuel were both invited, but only the chief of staff first agreed to later withdraw not to appear too cozy with Wall Street bankers. This invitation is nonetheless testament to the arrogance of invincibility that has shrouded executives of our most powerful corporations.

In Washington nothing gets done without support from Wall Street and Wall Street knows it. Wallshington is more important and influential than the oil industry, the industrial complex or even the powerful military. This has never been so true like it is today with a handful of firms left unfettered from the crisis and government’s control. Their power is more concentrated in the hands of a few and therefore even more difficult to control.

Executives on Wall Street get whatever they wish from every administration or congress there is. This too big to fail monster is sucking the lifeblood of morality, decency and sustainability out of a societal fabric that once was the envy of the rest of the world.

In the latest report for the period ending July 17, 2009, the Treasury department listed employed funds under the Troubled Asset Relieve Program (TARP). The financial industry received $204.2 billion, $70.2 billion have been returned, leaving the industry with a total of $134 billion outstanding. In the automotive industry $77.8 billion from 79.9 are still owed to the taxpayer. Automotive suppliers received a more humble $3.5 billion. Targeted investments in Citygroup and Bank of America totaled $40 billion and asset guarantee programs for Citigroup another $5 billion. The Troubled Asset Loan facility (TALF) committed $20 billion. Rescuing troubled insurer AIG required another $69.8 billion.

To this day the financial and the automotive industry owe the taxpayer $350 billion, yet government has devoted only $18.7 billion in home affordable modification programs to avoid foreclosures. While taxpayers were required to fund the bailout of Wall Street with 350 billion dollars the financial industry is reluctant to modify loans and scores of families are still forced out of their homes.

This current administration with the most eloquent president since years will have a hard time to sell this to the general public. Wall Street firms reverting to old habits by once again doling out mega bonuses to their club members will not make it any easer.

National Bank intervenes to weaken the Swissi

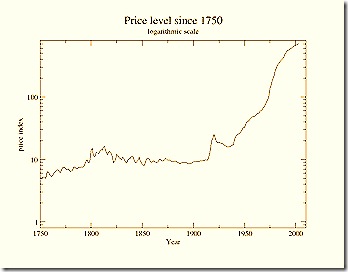

A picture is worth a thousand words. From 1750 to around 1900 price levels in England remained fairly stable. In the beginning of the 20th century prices took off bringing the first bout of major inflation during the roaring twenties, followed by a longer stretch of deflation during the Great Depression. Later price levels accelerated and never looked back to this day.

In 1914 the Bank of England to finance military operations during World War I suspended the gold standard, a monetary system where paper money is convertible to fixed quantities of gold. In 1925 after several years of significant inflation the British government returned the pound to the gold standard. The subsequent rise in demand for gold on conversion payments attracted major currency outflows from the US causing a serious contraction of money supply.

In the 1930s the beginning of the Great Depression prompted the British government to finally abandon the gold standard. After the Second World War only the US was upholding it by fixing the price of gold at $35 per ounce. In 1944 the Bretton Woods Agreement established a new monetary system by mandating fixed exchange rates between major national currencies. The US dollar remained pegged to the gold standard.

Major expenditures and the Vietnam War caused enormous fiscal strain to the US government. The balance of payment crisis that ensued led president Richard Nixon to abandon the gold standard in 1971. From there on a system of exchange rates based not on gold but rather fiat money was accepted as legal tender. In 1976 all major currencies followed a floating regime of exchange rates. This new system of fiat currencies enabled central banks to use interest rates rather than exchange rates themselves to meet certain targets of price stability.

The Nixon shock of de-pegging the US dollar form the gold standard caused a series of significant monetary and economic problems in the United States and its trading partners. In an attempt to revive the US economy the Plaza Accord was signed in September 1985. Several US trading partner agreed to let their currencies appreciate in favor of a weakening dollar. It was the first major combined intervention in this relatively new system of floating fiat currencies.

Under the free floating regime exchange rates should be determined by capital flows in currency markets with interest rates, the cost of carry and fiscal policies being the major monetary toolkit by central banks. Time and again since the Plaza Accord several countries have more openly or not intervened in currency markets to benefit their balance of payment accounts, prompting the emergence of the term managed free floats.

In general such interventions are doomed to fail if currency speculators are betting against it. Billionaire investor George Soros in betting against the British pound forced the Bank of England to withdraw its currency from the European Exchange Rate Mechanism.

First time since 1992 the Swiss National Bank has recently launched a preannounced series of currency interventions. Policy makers intend to hold down the franc in an attempt to counter deflationary pressures. In June consumer prices have dropped 1 percent from a year earlier and GDP has contracted 0.8 percent in the first quarter of 2009.

The reversal of carry trade, the borrowing of low-yielding currencies in exchange for higher-yielding assets, considered to be a major concern has led to the appreciation of the Swiss franc during the global credit crisis. Although in the months since March diminishing somewhat, this correlation is still pretty strong and the SNB is countering these forces by selling its own currency in open market operations.

The first intervention confirmed by the central bank was on March 12. That day the franc fell by a record one-day drop of 3.26 percent against the euro. According to traders the bank intervened several times since then but only confirmed another major open market operation on June 24.

SNB board member Jordan reiterated the bank’s commitment to prevent the franc from appreciating too much. Between 2006 and 2008 the franc traded at 1.61 per euro on average therefore traders might be looking at further depreciation of about 5.6 percent in the currency.

“The markets so far have well understood what our intentions are”, Jordan said in a July 2 interview. Currency traders have cut back on their bullish bets. Implied volatility on franc call options exceeds that of put options by only 4 basis points, the lowest level since 2007. On July 17 before the intervention, premium for call options to buy the franc was still 23 basis points.

On the downside for the Swiss bank is a continuing slump in the global economy, with a sustained output contraction well into 2010. This coupled with major risk aversion could bring the franc back into focus and render the bank’s intervention unsuccessful. How intervention does not always work proved the Bank of Japan which saw the yen appreciate about 15 percent despite major intervention between 2003 and 2004.

SNB is also concerned about not depreciating the franc too much since this could be construed as a “beggar thy neighbor” policy and put major trading partners in an unwelcomed disadvantage. The banks goal is to stabilize the franc at a level not acutely hurting the European currency.

Naturally forecasts about the near to medium term EUR/CHF currency cross are difficult but a trading range between 1.51 and 1.61 over the next 6 to twelve months seems reasonable. The SNB is expected to defend the 1.51 level in the EUR/CHF cross given the history of the most recent interventions.

This graph shows the 2 major SNB interventions (March 12, June 24) and subsequent jump in EUR/CHF cross:

Just how credible are Mr.Putin and Mr. Kadyrov?

On October 7, 2006, Russian journalist Anna Politkovskaya was murdered outside her apartment in Moscow because she was a critic of the Kremlin and its unmitigated support of the Chechen president Ramzan A. Kadyrov.

Three men were charged with the murder of Ms. Politkovskaya but on February 19, 2009, were unanimously acquitted by a Moscow jury. On June 25, 2009 the Russian supreme Court overturned the ruling and ordered a new trial. The alleged killer has never been charged and is still believed to be in hiding.

Almost three years after this heinous crime has been committed the killers are still free and yet Russia is believed to be a democracy based on the rule of law. The country has joined the international community of nations and president Obama has just recently finished a state visit with his Russian counterpart president Medvedev.

On Wednesday another devoted journalist was shoved into the back of a car as she left her apartment in Grozny, the capital of Chechnya, to turn up eight hours later with fatal gun shot wounds to her head and chest. Journalist and human rights activist Natalya Estemirova had been executed because of her work.

Chechen president Kadyrov was the main subject of journalistic investigative work by both Ms. Politkovskaya and Ms. Estemirova. He was the one who profited most from both killings by getting rid of outspoken and inconvenient critics.

Of course he denies any involvement and so do the president of Russia Medvedev and his predecessor Putin. Throughout the killings Russian leaders have always maintained their unmitigated support for Kadyrov.

Calls from the international community to streamline the investigation in bringing the killers to justice are met with phony concessions from both the presidents of Russia and Chechnya, but results have yet to follow. Almost three years after the murder on Ms. Politkovskaya her killer is still at large. There is little hope that the murder of Ms. Estemirova will be any different.

Goldman Sachs reports second quarter earnings

Meredith Whitney, the star analyst on Wall Street who correctly predicted the massive asset problems faced by all major investment firms during the last several quarters, increased her price target on Goldman Sachs. It prompted some to speculate if she had eventually flipped on her bearish posture on financial institutions in general.

I don’t know if she did but the results of Goldman’s second quarter, blowing past all expectations certainly didn’t make her job any easier. In the latest April to July quarter Goldman’s profit leaped 65 percent compared to the same period of last year.

It certainly makes one wonder what does Goldman have that others don’t. For one thing a Tier 1 ratio that is depending on how you look at it, whether its Basel I of II, at 13.8 or 16.1 percent respectively. In addition the amount of liquid assets averaged $171 billion during the quarter. That is certainly a nice capital cushion in case of a more adverse operating environment in the future.

The most staggering part of Goldman’s earnings release were the huge revenue gains of 93 percent to 10.8 billion within its equities and principal investment unit. Trading and risk taking really paid off and the firm greatly profited from much higher than usual volatility in the markets.

These ups and down in the market prompted Matt Taibbi, a business writer for the Rolling Stone magazine, to call Goldman the Great American Bubble Machine. Maybe after this earnings bonanza it becomes more clear why Taibbi felt compelled to make such an outrageous claim. Goldman promptly dismissed it as the usual conspiracy theory.

Taibbi’s accusation certainly helps to explain some of the investment firm’s wizardry, and his uncompromising look behind the firms machinations reveal a really sinister network of public and private interconnections (see also here). On a more straightforward note the mere fact that Uncle Sam changed financial accounting rules back in April might have laid the foundations for the biggest jump in quarterly earnings since its IPO.

In April the Financial Accounting Standard Board (FASB) succumbed to financial industry lobbying and lowered its requirements for market-to-market accounting of low liquidity investments without a real market. This move saved US financial institutions tens of billions of dollars in write downs to their balance sheets, which threatened to become an endless open pit.

At that point FASB only leveled the playing field for US financial institutions with their European counterparts, which according to IASB existing rules were not required to strict market-to-market in the first place. These days though IASB has again put the screws on financial institutions by threatening to implement new pro-cyclical rules in market-to-market accounting.

Getting back to Goldman, there is no denying the fact that the firm has a strong desire for excessive risk taking but they obviously seem to be able to maximize shareholder value even in a time more adverse to such high flying objectives. Again, what does Goldman have that others don’t?

Maybe it has to do with a high stake in another firm. Together with JPMorgan, Bank of America and Royal Bank of Scotland, Goldman is a major shareholder of Markit, a firm which supplies information to financial markets around the world concerning the pricing of credit derivatives. Many believe that these relatively new products are at the core of the financial meltdown.

The US Department of Justice is now requesting detailed information about the pricing of credit derivatives and has launched an investigation into the ways Markit supplies this information and whether the firms owners have unfair access to vital market-making data.

Markit of course denies any wrong doing, and so is Goldman I am sure, but hopefully the investigation will not stop here or just end in talk.

Regulating Wall Street – just how much change can we expect?

On the eve of the G-8/G-20 summit in L’Aquila the presidents of France and Brazil jointly published an article in The Huffington Post, the world’s first and famous internet newspaper, titled ‘Alliance for Change’. Their choice of this outlet speaks volume, men of such caliber never do anything without careful consideration.

The first thing comes to mind is a desire to reach a vast international audience more inclined to follow their vision of a new system of world governance. We can therefore assume that whatever it is they are suggesting is revolutionary enough to stir up some controversy and at least for now made them stay away from more traditional news channels.

What Mr. Sarkozy and Mr. daSilva are jointly suggesting is no less than a redundancy of the Group of 8 (G-8) in favor of a much wider allegiance of nations with respect to issues concerning global governance. A multilateral system that was conspicuously unrepresentative and lacking in coherence must be reformed to build a more just, developed and sustainable world.

The G-20 or similar to L’Aquila the G-8 together with the G-5/G-6 are both multilateral platforms on which to discuss various global issues in an interconnected framework. Those issues are indeed monumental and both presidents acknowledged the urgency of a multilateral system by highlighting most of the challenges that face the global community in the 21st century.

Peace and collective security require a wide-ranging reform of the U.N. Security Council. The voice of workers must be heard and their desire for more social justice and greater security met by strengthening the role and influence of the International Labour Organization (ILO) in global economic governance. Last but not least on the agenda of such an international framework is the enormously challenging task of regulation of international finance.

From Huff Post, both presidents: The decisions taken by the G-20 to improve the regulation and oversight of international finance, to curb speculation, to crack down on tax havens and money laundering centers, and to foster growth must be implemented.

Politicians are very often a bunch of stoic bureaucrats, but no not this time. Sarkozy, daSilva and hopefully others at the recent summit are ready to see eye to eye maybe for the first time with their constituency and clearly acknowledge the vacuum of social justice pervading all layers of society in the 21st century.

This reinvigoration of literally common sense results on the one hand from the advent of Barak Obama and his new leadership in the U.S. and on the other hand from a massive global financial and economic crisis that threatens the very foundations of global world order.

The president of the U.S. has demonstrated his desire for change in many ways but has he been effective and is change indeed coming to Washington, as he has promised many times? The global economic crisis has made regulation of financial markets and the financial industry as a whole a top priority.

Today Goldman Sachs, Deutsche Bank, UBS and others are equipped with an almost unmitigated license to gamble and at the same time fall into the category of too big to fail. This is not sustainable and even the Bank for International Settlements (BIS) is now openly debating a breakup of these giant cathedrals of capitalism.

The Financial Stability Forum and its successor the Financial Stability Board (FSB) in Basel is working on new rules to give regulators more oversight in establishing important issues such as excessive leverage and forcing banks to provide for anti-cyclical periods with putting more money aside during boom times.

They are asking for an awful lot given the most recent history of the industry but nobody disagrees bold action is necessary because of the magnitude of the current crisis. At the eve of the London summit Nikolas Sarkozy threatened world leaders to quit the talks if president Obama and chancellor Gordon Brown would resist tough regulation.

They did not and so in the end it provoked Mr. Sarkozy to say that the page of the Anglo-Saxon model of free markets had been turned. German chancellor Angela Merkel called it a victory for common sense and Nobel Laureate and economist Stiglitz hailed it a historic moment for the world to admit the push for deregulation was wrong.

The joint communiqué of the London summit included a statement acknowledging major failures in regulation being the cause of the market turmoil. To avoid another crisis hedge funds, credit rating agencies, risk taking and executive pay are subject to stricter regulation in the future.

Just how much more regulation and who those regulators will be nobody knows at this point. It is hard to fathom that a bunch of bureaucrats will be able to reign in Wall Street executives and their armada of lobbyists swarming the hallways of congress. For regulators to push the breaks when everybody else wants to accelerate seems too much to ask, in particular given the history of failed regulations in the past.

A contentious issue in this whole regulation debate is the use of credit derivatives and their contribution to the current crisis. At a recent congressional hearing on a proposal to regulate over-the-counter derivatives congressman Sherman asked Treasury secretary Geithner: “Can you correct that misconception and make a clear statement now that derivatives that are sold today are not going to be the subject of bailouts for either the issuer or the purchaser?”

The secretary even after being asked several times refused to give an answer (the full transcript of the conversation can be seen here, video in video-center). Mr. Geithner’s refusal to cooperate highlights the difficulty of the enormous task that lies ahead.

On the one hand is the commitment to put on the breaks with tougher regulations for the sake of the sustainability of the system. On the other hand are all the safeguards put into place to make sure that this ambitious goal will not kill the golden goose. It is therefore no surprise that credit derivatives experience sort of a revival in the midst of a still slumping economy, mass layoffs and record taxpayer funded economic stimulus programs.

The president of France, Brazil and other nations are talking tough on regulation but in the meantime BAB is back on Wall Street. Today Goldman Sachs released the results for second quarter earnings and revealed that bonuses are indeed back. Goldman compensation may very well reach a record $1 million per employee this year.

For the second quarter the bank set aside a staggering $226,156 for every employee working for the firm. A couple of months ago with Wall Street and the World at the precipice of catastrophe, Goldman received a $10 billion bailout in taxpayer money.

It is no surprise Wall Street has a very short memory but this development gives me indeed little hope that regulation is being seriously considered in the hallways of power on Wall Street and in Washington. Just how much change will we get in the end? Probably not enough!

The case US justice department against UBS

250 – 52000 – 7000.

In February Swiss bank giant UBS to settle a criminal investigation agreed to disclose 250 secret accounts from US customers. A landmark decision as it turned out because now the IRS of course wants more. The US government is finally determined to crack down on tax evaders who for decades stashed away hundreds of billions of dollars in secret foreign accounts.

UBS had originally agreed to disclose this small number of 250 on potential evidence of fraud associated with the accounts. The IRS now wants 52000 more tax evaders hiding in the vaults of the Swiss bank to pay their dues or else face the justice department.

The Swiss bank is now caught in this vice between the mighty US Department of Justice and the laws of its own country. Swiss law in an attempt to provide confidentiality forbids the bank to hand over the list of accountholders to the IRS. Government has already threatened to confiscate any Swiss document UBS would be required to hand over to US authorities. No matter what UBS seems on track to break the law. It therefore requested help from its own government to engage in direct discourse with Washington.

Judge Alan Gold, who presides over the civil law suit against UBS in the federal district court in Miami, has set July 13 hearing on whether to enforce the “John Doe summonses”. Washington has asked the judge to postpone his decision. It looks as if Washington is up for a diplomatic solution in this case, a kind of government bailout of a legal predicament UBS and the US Department of Justice got themselves into.

But no matter what UBS seems to be on the losing end of this conflict, because as all parties involved will try their best to save face the third way will require money, lots of it. UBS will be squeezed like a lemon. In February the bank had already settled its dues by disclosing 250 secret accounts and paying $780 million to the US government. This time we are talking about 52000 accounts that would amount to 150 billion US dollar. Others expect UBS to pay a fine tantamount to a certain percentage of total taxes still owned to the US government. I think that is more realistic, but whatever it is it will hurt the bottom line of an already beleaguered balance sheet.

Swiss law allows for disclosure of otherwise secret accountholders if there is evidence of fraud associated with them. The actual number of accounts at UBS drawing increased scrutiny will be more likely closer to 7000. These ominous 7000 are tied to offshore companies and trusts and are therefore more susceptible to fraud. Another 17000 more lucky accounts are less prone to have violated the law and are therefore save.

Judge Gold in a sign of precariousness about the situation asked Washington if they would be ready to seize UBS assets in case of an adverse verdict. It is obvious there is no legal precedence for this kind of procedure and diplomatic intervention is called for to settle this dispute between the US and Switzerland. According to Scott Michel, a lawyer who represents about 200 UBS clients in this case, a direct engagement of the White House will probably prevent the disclosure of names from account holders all together.

Once again the balance of justice is on a very very fine scale, this time by creating two classes of tax evaders. Those who violate the law and those who only bend it, the former being punished the latter going free. High finance much like high politics seem to be stuck forever in a thicket of dishonesty which begets only more dishonesty.

Is there a rift between the democratic party and the Obama administration?

I have written about Goldman Sachs and how the investment firm contributed to the worst financial crisis since the Great Depression. Matt Taibbi alluded to GS as The Great American Bubble Machine contributing substantially to all major investment bubbles since the 1930s. GS has always been a talent hotbed where privileged alumni leave the firm through what Stieglitz calls a revolving door to end up in critical positions of government. The list of those exiting Goldman and entering the government is long, but it is clear that they are all associated with the Democratic party.

Next to this one there could be another list, one of detrimental political decisions that contributed to the current crisis. On top of it is the repeal of the Glass-Steagall-Act under former GS employee and Bill Clinton’s Treasury secretary Robert Rubin, which allowed bank holding companies to own other financial institutions and eventually become too big to fail and a systemic risk. This of course was never intended but as we painfully recognize one of those far-reaching wrong judgments made by a democratic administration. In light of this anything but impeccable track record we have to ask if democrats are truly forthcoming in their desire for real change or are they about to make another big mistake?

In November of 2008 a new spirit of political leadership in the US was finally entering into the halls of congress and the White House. President Obama has promised to bring change to Washington and the democratic party vowed to stand beside him and his ambitious agenda. In the meantime democrats together with two independents have a sound filibuster majority of 60 in the senate. They are now calling the shots in the government and the legislature. It is therefore even more disturbing to see how the House of Representatives overwhelmingly rejected a signing statement from their president.

In June a $106 billion war supplemental bill passed legislation in the House and Senate which included conditions on World Bank and IMF funding. The bill would extend a credit line of $108 billion for international financial institutions (IFI) to aid struggling developing economies crippled by the current financial and economic crisis. Major recipients of IFI funds could be nations in Eastern Europe under immense pressure to devalue their currencies in an attempt to avoid a default scenario. This would have a ripple effect and threaten the stability of the global financial system similar to events during the Asian crisis in the late 90s.

Despite severe and eventually devastating consequences to an already ailing global financial system of such a devaluation scenario, resistance is mounting among lawmakers who view IFI funding as an unnecessary ‘global bailout’ . To reach a compromise and find the votes to pass the bill House and Senate leaders included restrictions resulting in an amendment requiring the Treasury department to report on World Bank and International Monetary Fund (IMF) activities. Late Thursday the amendment passed with strong bipartisan support and an overwhelming majority of 492-2 votes against the Obama administration.

The president in a statement during signing of the original bill rejected this restrictions and vowed to ignore the amendment’s conditions. They would "interfere with my constitutional authority to conduct foreign relations (with international organizations and foreign governments)… by requiring consultation with the Congress prior to such negotiations or discussions," Obama said in the signing statement. With the passage of the amendment lawmakers including Barney Frank, a democrat and head of the powerful House Financial Services Committee (HFSC), are now threatening to withhold funds in a stand-off with the Obama administration.

492 to 2 speaks a clear language and it remains to be seen if the administration can afford to ignore congress under these conditions. Though it certainly would mean a severe blow to the authority of the president if he will be forced to revoke his signing statement. His foray into environmental politics (see also here), for the first time opening up the United States to international commitments to substantially reducing carbon emissions, could be called into question. So could his commitments he made during his Moscow speech (see also here), to the establishment of an international body together with and under the leadership of the U.S.

Much needed reform in Washington away from neoliberalism towards true and sustainable world leadership hangs on a thread. While first signs emerge of a search for an effective international body that more truthfully represents interests of all nations in a global economy, the coverage of the G-8 summit in Italy by mainstream media in the U.S. suggests otherwise.

The media are either ignoring or mocking efforts of the G-8 to increase the scope of their discussion round tables by opening it up to other powerful nations like China, Brazil, India, Mexico, South Africa and others. The NYT writes: “Eventually, the so-called Group of 8 started what might be considered auxiliary clubs. And that was how they ended up with a meeting on Thursday that was actually dubbed the G-8 + 5 + 1 + 5. Seriously.”

The Times also calls into question the relevance of the G-8 if they seemingly cannot take landmark action without enlisting others, and misses the point completely: It is not about relevance of the G-8 but rather about sustainable credibility within the G-15, G-20 or even G-194. It is not about America but rather about sustainable relations between all nations in a political and economic environment more and more intertwined by globalization. If we have learned nothing else from the current financial and economic crisis this should be it.

Leaving other nations out makes the G-8 nothing but an elite club of snobbish leaders who in a reactionary move desperately seek to conserve neoliberal, neoconservative mindset. Barak Obama, Angela Merkel, Nicolas Sarkozy and other powerful leaders understand that and therefore support this search for a new international world order. Reactionary dinosaur politicians will eventually face the same destiny. In the meantime there are still too many of them and they are still very powerful. President Obama’s stand-off with the congress on the issue of the signing statement serves as a litmus test about the determination towards change in a modernized America.