Posts Tagged ‘lobbying’

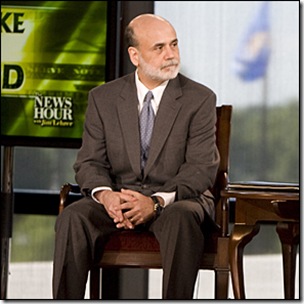

Bernanke in a town-hall meeting, shopping for popularity

Last Sunday Ben Bernanke, chairman of the Federal Reserve responded to questions from the public in a town-hall style meeting. For the first time in history an acting Federal Reserve chair stepped into the arena that is usually the prerogative of obligations among elected officials. We truly live in interesting times.

What could have provoked this extraordinary move by the chairman given the daunting unpopularity of cumulative actions taken by the Fed in the last twenty four months? The answer is already given in the question. Ben Bernanke is shopping for popularity in order to better his approval ratings. His term as chairman ends in January 31, 2010, when he is up for reappointment by president Obama.

I can only imagine it must have been scary and embarrassing for the chief to step in front of the very same audience he led down over the course of the last ten years. He certainly did not mean to inflict any harm upon his fellow countrymen, but together with his predecessor Greenspan he helped lay the foundations of a shaky economy based on bubble economics.

Sure he gave birth to many millionaires and even some billionaires, but for most people Greenspan’s and Bernanke’s policies were rather harmful. Certainly one cannot expect any sensational outcome of such meetings with both a preselected audience and preselected questions. Organizers won’t let that happen though the chairman won’t suffer any lasting damages. It would have been nice though to read Bernanke’s mind.

To his defense the chairman admitted that he was disgusted from bailing out giant Wall Street firms like AIG, Bear Stearns or Merrill Lynch and rescuing them from going bankrupt. Though we certainly respect his wish not to reside over a second Great Depression, of course we have to believe him that there were no other options at the time. I might also add we are not yet with absolute certainty out of the woods with regard to another Great one.

Asked about his too-big-to-fail policy he seemed to indicate sympathy for the public’s frustration and promised to make it better in the future. Though his credibility was called into question by reiterating his opposition to an independent outside audit of the Fed. Why no audit if he has nothing to hide? Yes there is the issue of independence of the Fed, but just how much independence was there say in the last ten years?!

The Federal bank closest to Wall Street, and therefore in a special position with regard to the nation’s largest financial institutions, is the Federal Reserve Bank of New York. During the financial crisis Federal Reserve and Treasury Department officials made all major decisions, but the New York Fed executed them.

In the meantime the New York Fed has been criticized as too close to Wall Street. William Poole, a former Fed president, missed a longer-run perspective among the Fed’s staff. They adopted a trader mentality instead and did not pay enough attention to a system skewed towards too much risk taking by numerous bailouts of large Wall Street firms.

The Fed’s board of directors is composed of powerful bankers and corporate titans like Jamie Dimon, the head of JPMorgan Chase, and Jeffrey Immelt, General Electric’s chief. Richard Fuld had to resign after Lehman’s bankruptcy and Stephen Friedman called it quits over a conflict of interest with the other board he served, of investment power house Goldman Sachs. The corporate-federal officials network seems too tight to ever disintegrate.

It is not only the Federal Reserve that has to fear for its independence. The lobbying departments of large financial institutions have expelled their tentacles even into the Financial accounting Standards Board (FASB) of the United States and the International Accounting Standards Board (IASB) of Europe.

According to a recent report by an international team of former regulators and corporate officials, the Financial crisis Advisory Group deplored efforts by politicians to prescribe changes on accounting standards. The integrity of valued assets on the books of financial institutions should not be called into question in an effort to save those institutions from potentially harmful bets gone awry. In April, 2009, FASB already caved in to heavy financial lobbying and paused fair-value accounting rules for illiquid assets.

Beside all the regulatory and statutory powers bestowed on elected or appointed officials their most potent tool still remains the integrity of the person and organization in question. It is by no means sufficient for Fed chair Bernanke to communicate his objection to the bailouts on Wall Street even if it is within such an elaborate setting of a town-hall meeting. There is not enough meet on the bone to undo what has already happened.

A Gallop poll, conducted in mid-July, found that only 30% rated the Fed as doing an excellent/good job. The bank had the lowest score out of nine government agencies and it was down sharply from the 53% who still approved of the Fed’s job in 2003. This time even the CIA and the Internal Revenue Service scored better than the Fed. Bernanke will have to do better. It will most certainly be like walking a tightrope.

Written by Alfred

31. July 2009 at 7:20 pm

Posted in Banks, Capital Markets, Federal Reserve, Wall Street

Tagged with approval rating, bailout, Ben Bernanke, bubble economics, FASB, Fed, Federal Reserve, Gallop poll, IASB, lobbying, New York Fed, too-big-to-fail, Wall Street

US to Israel – make peace with Palestine

Not everything is quiet on Obama’s front. Economic crisis, unemployment, the crisis on Wall Street, executive compensation, General Motors, the environment just to name a few issues he has to tackle and he is only in his mid fifties. Oh, not to speak of a record current account deficit that is now poised to break through the alarming 1 trillion dollar mark.

On foreign policy two wars, in Irak and Afghanistan, are still looming high and no end seems in sight. The solutions promised to the people in the Middle East are a reason for deep frustration. Israel-Palestinian peace negotiations seemed to have stalled in part because of lack of leadership from the US. And above all the nuclear stand-off with Iran.

President Obama has more than once stated during his campaign speeches that he is frustrated with the lack of progress in the Israel-Palestinian conflict. He sees it as a "constant sore" that "infect[s] all of our foreign policy". Vice-president Jo Biden and General James Jones, Obama’s national security adviser, wowed to be ‘more forceful toward Israel than under Bush’.

This has alarmed a powerful pro-Israel lobby group in the US to get Congress to deliver a written letter to president Obama in an attempt to right what seemed wrong for Israeli hardliners. The American Israel Public Affairs Committee (Aipac) calls on the US to remain a devoted friend of Israel. Aipac wants to maintain the current pace of negotiations with the Palestinians and does not see this conflict crucial to peace in the Middle East. By the way Aipac also wants military attacks on Iran’s nuclear facilities something the Obama administration clearly rejected so far.

Aipac is very powerful and has considerable influence over American lawmakers. Their message is clear, that there will only be a two-state solution when Israel is ready for it. Well, they had about 60 years now, that is a lot of prep time. So, hopefully Obama stays the course so as to this region will have peace in our lifetime.

There are considerable forces that work against a two-state solution. Netanyahu’s speech about the conditions for a formation of a Palestinian state was meant to be rejected and certainly will not in anyway open a door for successful peace negotiations.

The Obama administration is under considerable stress concerning the nominations of some of their top administrative positions. In March Chas Freeman, a veteran American diplomat and former ambassador to Saudi Arabia, had to withdraw as chairman of the national intelligence council. Behind this move is arguable Freeman’s criticism of Israel.

The "Israel Lobby", he argued, was stifling any discussion of US policy options in the Middle East except those endorsed by "the ruling faction in Israeli politics" – a situation that could "ultimately threaten the existence of the state of Israel".

This underscores the alarmingly powerful influence Aipac has in Washington and although the last elections brought hope of change, so far its the same ol same ol. Wait, maybe not so fast. Obama has obviously sacked a state department advisor on Iran. Dennis Ross, Hillary Clinton’s special adviser on Iran has been removed from his post because of reports that Tehran was unwilling to engage with him. Ross is believed to be very close with Israel. The real reason for his removal is his rejection of the Obama administration’s approach to the Middle East. Mr. Ross sees himself eye to eye with Aipac and Netanyahu. Well his boss did not like it and fired him.

I hope we will see more of this, because it is absolutely clear by now that peace in the Middle east will only come if Israel will be forced to accept it.

Written by Alfred

16. June 2009 at 6:17 pm

Posted in Middle East, Politics, posts in english, U.S.A.

Tagged with Aipac, Israel, lobbying, Netanyahu, Obama, Palestinians, Washington